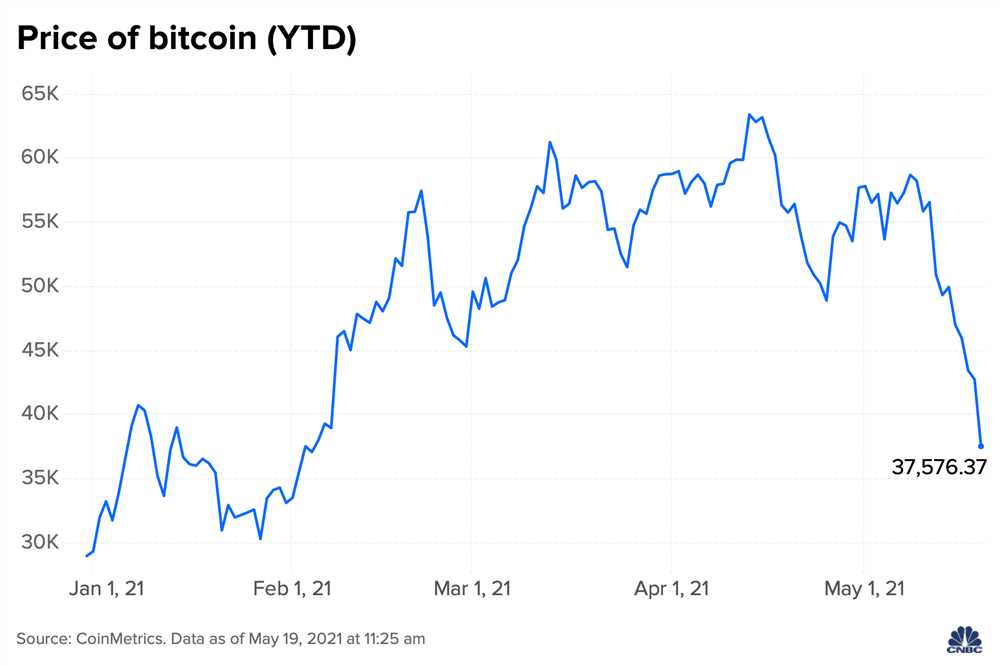

Are you fascinated by the world of cryptocurrencies? The ever-changing landscape of digital currencies constantly presents new opportunities for investors, traders, and enthusiasts alike. However, with great potential comes great volatility.

Price fluctuations in the cryptocurrency market are a well-known phenomenon, often leaving investors uncertain and hesitant. The cryptocurrency market can be a roller coaster ride, with prices changing rapidly and unpredictably.

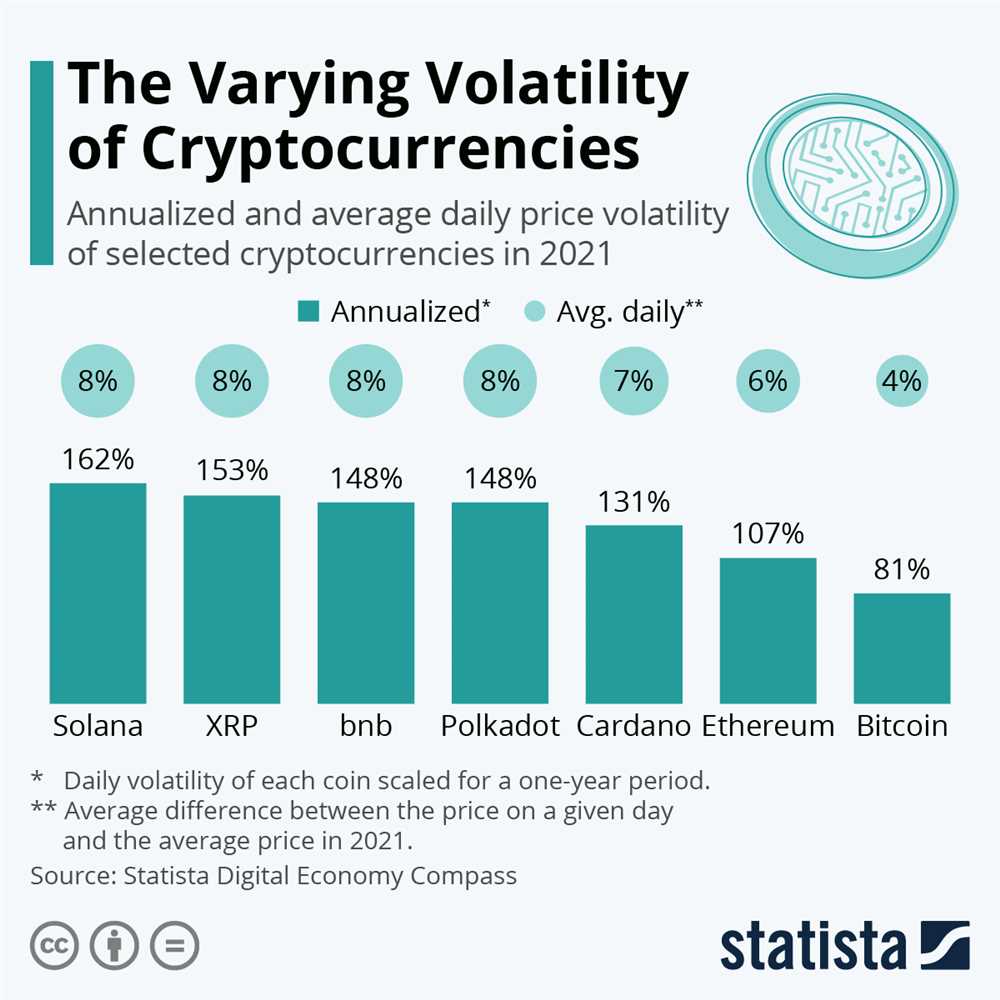

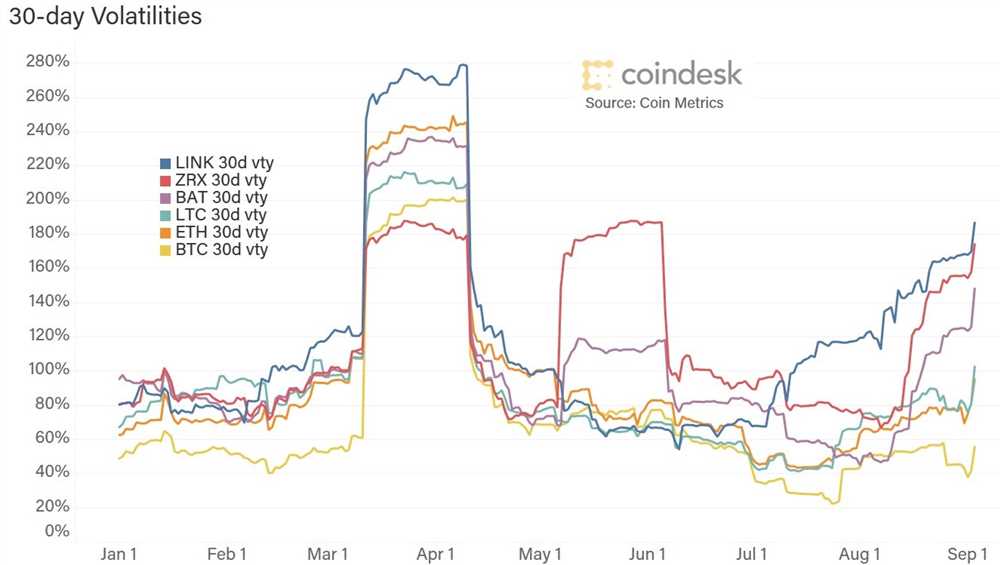

From massive gains to sudden drops, the blurry lines of price fluctuations can be both exhilarating and challenging to navigate. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have seen unprecedented growth, but along with it, increased volatility.

For those brave enough to enter the crypto space, understanding and staying ahead of market trends is essential. Stay informed, do your research, and be prepared to embrace the roller coaster ride that is cryptocurrency trading.

Overview

Cryptocurrency market volatility is a phenomenon that has both intrigued and baffled investors since the inception of digital currencies. With prices constantly fluctuating, the lines between potential profits and losses can become increasingly blurry.

In simple terms, market volatility refers to the rapid and unpredictable changes in the price of a cryptocurrency over a short period of time. This can be attributed to various factors, such as market demand, investor sentiment, regulatory developments, and technological advancements. As a result, the value of a cryptocurrency can experience significant ups and downs within a matter of hours or even minutes.

While some investors thrive in volatile markets, others find it extremely challenging to navigate the uncertainties. The potential for high returns attracts risk-tolerant individuals, while risk-averse investors may shy away due to the inherent unpredictability. Understanding and managing volatility is essential for anyone looking to participate in the cryptocurrency market.

One of the key factors contributing to cryptocurrency market volatility is the lack of regulation and oversight. Unlike traditional financial markets, cryptocurrencies operate in a decentralized and unregulated environment. This means that market manipulation and speculative trading can have a significant impact on prices. Additionally, news events and announcements related to cryptocurrencies can trigger rapid market reactions, leading to price swings.

Cryptocurrency market volatility is further exacerbated by the lack of fundamental value. Unlike stocks or commodities, cryptocurrencies do not have underlying assets or cash flows to support their value. Instead, their worth is largely determined by market sentiment and speculation. This lack of intrinsic value makes cryptocurrencies highly susceptible to fluctuations and makes it difficult to reliably predict their future performance.

Despite the challenges posed by volatility, it is important to note that it also presents opportunities for savvy investors. Rapid price movements can result in substantial gains when timed correctly. However, this requires a deep understanding of the market, careful analysis, and a tolerance for risk.

In conclusion, cryptocurrency market volatility is a defining characteristic of the digital currency landscape. It introduces both risks and rewards, making it a rollercoaster ride for investors. Being aware of the factors that contribute to volatility and understanding how to navigate the uncertainties can help individuals make informed decisions and potentially capitalize on the opportunities presented by this ever-changing market.

Factors Influencing Volatility

There are several factors that contribute to the high volatility of the cryptocurrency market. These factors can vary in nature and can be influenced by a wide range of variables. Understanding these factors is crucial for investors and traders to make informed decisions and manage their risks effectively.

1. Market Demand and Supply

The demand and supply dynamics of cryptocurrencies play a significant role in determining their price fluctuations. When the demand for a particular cryptocurrency exceeds its supply, the price tends to rise, leading to increased volatility. Conversely, when the supply surpasses the demand, the price tends to decrease, resulting in higher volatility in the opposite direction.

2. Regulatory Environment

The regulatory environment surrounding cryptocurrencies has a profound impact on their volatility. Government regulations, laws, and policies can significantly affect the overall sentiment towards cryptocurrencies, leading to increased price volatility. Positive regulatory developments often result in increased investor confidence and can drive prices higher, while negative regulatory news can cause panic selling and lead to sharp price declines.

It’s important to note that the regulatory landscape for cryptocurrencies is still evolving and can vary significantly between countries and regions.

3. Technological Advancements and Innovation

The technological advancements and innovations within the cryptocurrency industry can contribute to increased volatility. The introduction of new features, protocols, and blockchain updates can spark excitement and speculation among investors, leading to rapid price movements. Additionally, any technical issues or vulnerabilities discovered in existing cryptocurrencies can also significantly impact their prices.

Investors should closely monitor technological advancements and stay updated on the latest developments within the cryptocurrency space to anticipate potential price volatility.

In conclusion, the volatility of the cryptocurrency market is influenced by a combination of factors, including market demand and supply, regulatory environment, and technological advancements. By understanding these factors and conducting thorough research, investors can better navigate the volatile nature of the cryptocurrency market and make informed investment decisions.

Impact on Investors

Investing in cryptocurrency can be highly lucrative, but it also comes with its fair share of risks. The extreme volatility in cryptocurrency markets can have a significant impact on investors.

One of the biggest challenges that investors face due to market volatility is the unpredictable and rapid price fluctuations. Cryptocurrencies like Bitcoin and Ethereum have been known to experience massive price swings within short periods of time. This can lead to both substantial gains and devastating losses for investors.

For some investors, the high volatility can be a double-edged sword. On one hand, if they time their trades correctly, they can take advantage of the price fluctuations and make significant profits. On the other hand, if their timing is off, they can easily lose a substantial amount of their investment.

Another impact of market volatility on investors is the emotional rollercoaster it can induce. Seeing the value of their investments rapidly rise or fall can create feelings of excitement, fear, and even panic. This emotional turbulence can lead to impulsive decision-making and can cloud investors’ judgment.

Furthermore, the high volatility can also attract speculative traders and pump-and-dump schemes that manipulate the market for their own gains. This can create a dangerous environment for investors, as they may fall victim to fraud or market manipulations.

It’s important for investors to understand the impact of market volatility and to be prepared for the risks associated with it. Diversifying their investment portfolio, setting realistic expectations, and staying informed about the latest market trends and news can help mitigate some of the risks and make smarter investment decisions.

In conclusion, the impact of market volatility on investors in the cryptocurrency market is significant. While it can offer opportunities for substantial profits, it also poses risks that can result in substantial losses. It’s crucial for investors to approach cryptocurrency investing with caution and to be prepared for the volatility that comes with it.

Strategies for Dealing with Volatility

Dealing with the volatile nature of the cryptocurrency market can be challenging, but with the right strategies, you can navigate these uncertain waters and protect your investment. Here are some effective strategies for dealing with volatility:

1. Diversify Your Portfolio

One of the best ways to mitigate the risk of volatility is to diversify your cryptocurrency portfolio. Investing in a variety of cryptocurrencies can help spread out your risk and protect you from the fluctuations of a single coin. Make sure to choose cryptocurrencies from different sectors and with different risk profiles to create a balanced portfolio.

2. Set Realistic Goals

Volatility can make it tempting to chase short-term gains or panic sell during price dips. However, it is important to set realistic investment goals and stick to your long-term strategy. By focusing on your long-term goals, you can avoid making impulsive decisions based on short-term price changes.

3. Stay Informed

Keeping up with the latest news and developments in the cryptocurrency market is essential for understanding the factors driving price fluctuations. Stay informed about regulatory changes, technological advancements, and market trends to make better informed investment decisions. Join online communities, follow reputable sources, and stay connected to the crypto community.

4. Use Stop-Loss Orders

Stop-loss orders can be a valuable tool when dealing with volatility. By placing a stop-loss order, you can automatically sell your cryptocurrency when it reaches a certain price. This can help limit your losses if the market takes a downturn. However, be cautious not to set the stop-loss order too tight, as it may result in unnecessary selling during short-term fluctuations.

5. Consider Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where you regularly invest a fixed amount of money into cryptocurrencies, regardless of their price. By spreading out your purchases over time, you can reduce the impact of short-term price fluctuations. This strategy avoids the temptation to time the market and can be an effective way to accumulate cryptocurrency over the long term.

6. Have a Risk Management Plan

Volatility comes with risks, so it’s essential to have a risk management plan in place. Determine your risk tolerance and set clear rules for when to exit a position or cut your losses. Having a plan can help you stay disciplined and avoid making emotional decisions during turbulent market conditions.

7. Seek Professional Advice

If you are new to cryptocurrency investing or feel overwhelmed by the volatility, consider seeking professional advice. Consulting with a financial advisor or cryptocurrency expert can provide you with insights and guidance on how to navigate the market and manage volatility effectively.

By implementing these strategies, you can better handle the volatility of the cryptocurrency market and increase your chances of success in the long run.

What is this book about?

This book is about the volatility of the cryptocurrency market and how it affects price fluctuations.

Why is the cryptocurrency market so volatile?

The cryptocurrency market is volatile due to various factors such as market demand, regulatory changes, technological advancements, and investor sentiment.

Leave a Reply