In today’s dynamic and interconnected financial markets, the price of cryptocurrencies can be influenced by a multitude of external factors. This is particularly true for Blur Token, a digital asset that has gathered significant attention and popularity in recent times.

Blur Token is a decentralized cryptocurrency that operates on the Ethereum blockchain. Its price is determined by a complex interplay of various factors, including market demand, investor sentiment, and external events. Understanding the impact of these external factors on Blur Token’s price is essential for investors and traders looking to make informed decisions.

One of the key external factors that can influence Blur Token’s price is regulatory news and actions. Cryptocurrencies operate in a regulatory gray area in many countries, and any announcement regarding potential regulations or bans can have a substantial impact on their price. For example, positive regulatory news that promotes the adoption and acceptance of cryptocurrencies can lead to a surge in Blur Token’s price, while negative news can cause a significant drop.

Another external factor that can affect Blur Token’s price is market trends and developments. This includes the overall sentiment and behavior of investors towards cryptocurrencies, as well as developments in the broader financial markets. For instance, during times of economic uncertainty or instability, investors may flock to cryptocurrencies as a hedge against traditional assets, which can drive up the demand and price of Blur Token.

Understanding the Factors Affecting Blur Token Price

When it comes to determining the price of Blur Token, there are several factors that come into play. These factors can range from external market influences to internal project developments. Understanding and analyzing these factors is crucial for investors and traders to make informed decisions.

1. Supply and Demand: Supply and demand dynamics play a significant role in determining the price of any cryptocurrency, including Blur Token. If the demand for Blur Token exceeds the available supply, the price is likely to increase. Conversely, if the supply surpasses the demand, the price may decrease.

2. Market Sentiment: Market sentiment refers to the overall attitude of investors and traders towards a particular cryptocurrency. Positive news and developments surrounding Blur Token, such as partnerships or new listings, can boost market sentiment and drive the price upwards. On the other hand, negative events or regulatory concerns can dampen market sentiment and lead to a decrease in price.

3. Economic Conditions: The general economic conditions, both globally and locally, can impact the price of Blur Token. Factors such as inflation, interest rates, and geopolitical events can influence investor sentiment and market behavior. A robust economy with positive growth prospects can attract more investors and drive up the price, while economic downturns can have the opposite effect.

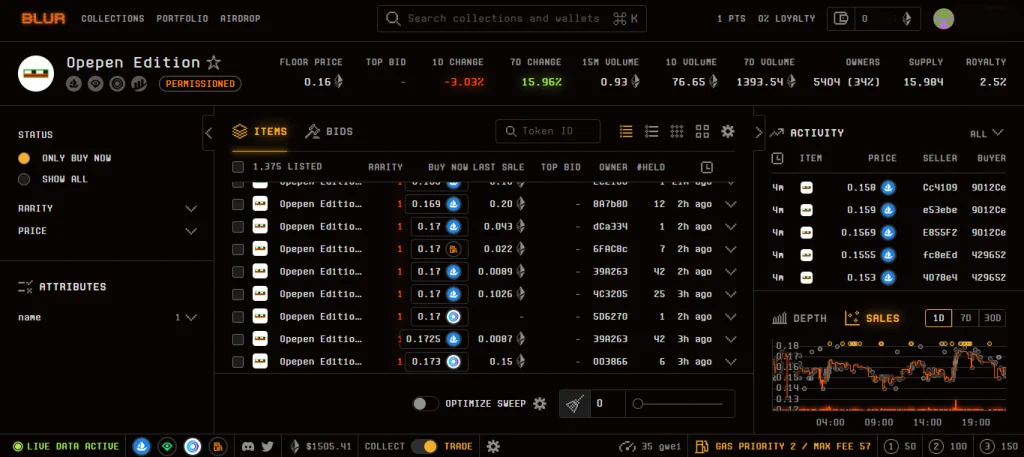

4. Technological Advancements: Technological advancements within the Blur Token ecosystem can have a significant impact on its price. For example, the introduction of new features or upgrades that enhance security, scalability, or user experience may increase investor confidence and drive up demand, thereby increasing the price.

5. Regulatory Environment: The regulatory environment surrounding cryptocurrencies can greatly affect their price. Changes in regulations or uncertainties regarding the legal status of cryptocurrencies can lead to increased volatility and price fluctuations. Clarity and supportive regulations often attract more investors and can positively impact the price of Blur Token.

6. Competitor Landscape: The presence of competitors offering similar solutions or technologies can impact the price of Blur Token. Investors and traders evaluate the strengths and weaknesses of competing projects and make investment decisions accordingly. Increased competition can lead to price declines, while a lack of strong competitors can drive up the price.

7. Project Development: The progress and milestones achieved by the Blur Token project itself can heavily influence its price. Positive developments, such as successful partnerships, network upgrades, or the launch of new products or features, can generate excitement and attract more investors, resulting in a price increase. Conversely, project delays, technical issues, or security vulnerabilities may lead to a decrease in price.

It is important to note that these factors are interconnected and can influence each other. Therefore, a comprehensive analysis of all the relevant factors is necessary to form a well-rounded understanding of what drives the price of Blur Token.

External Factors Shaping Blur Token’s Value

Several external factors can significantly impact the value of Blur Token in the marketplace. These factors include:

- Market Demand: The overall demand for digital assets and cryptocurrencies can greatly influence the value of Blur Token. If there is a high demand for cryptocurrencies, including Blur Token, its price is likely to increase. Conversely, if the demand decreases, the value of Blur Token may decrease as well.

- Regulatory Changes: Any regulatory changes or new legislation regarding cryptocurrencies can greatly impact Blur Token’s value. Governments and regulatory bodies may impose restrictions or regulations that affect the use or trading of cryptocurrencies, leading to potential price fluctuations.

- Technological Advancements: Technological advancements that improve the functionality and security of Blur Token can positively impact its value. For example, the development of new blockchain technologies or enhancements to existing ones can increase investor confidence and drive up the price of Blur Token.

- Media Attention: Media coverage and public sentiment towards cryptocurrencies can also play a significant role in shaping Blur Token’s value. Positive news and endorsements from influential figures can lead to increased demand and higher prices, while negative coverage or security concerns may lead to a decline in value.

- Macroeconomic Factors: Broader economic factors, such as inflation, interest rates, and geopolitical events, can impact the value of Blur Token. Changes in global economic conditions can sway investor sentiment towards cryptocurrencies, which can ultimately affect Blur Token’s price.

It is important for investors and stakeholders to monitor these external factors and stay informed about any developments that may impact Blur Token’s value. By understanding these factors and their potential implications, individuals can make more informed decisions regarding their investments in Blur Token and navigate the cryptocurrency market more effectively.

The Impact of Market Demand on Blur Token Price

The price of Blur Token is influenced by various external factors, one of which is market demand. Market demand refers to the level of interest and desire for Blur Token among investors and traders. When market demand for Blur Token is high, the price tends to increase, and when market demand is low, the price tends to decrease.

1. Investor Sentiment

Investor sentiment plays a crucial role in determining market demand for Blur Token. Positive investor sentiment, driven by optimism and confidence in the project, can result in increased demand and higher prices. Conversely, negative sentiment can lead to decreased demand and lower prices.

2. Speculation

Speculation is another factor that influences market demand for Blur Token. Speculators are individuals who buy and sell Blur Token with the expectation of making a profit from price fluctuations. Their actions can drive up demand and increase the price if they believe the token’s value will rise in the future.

However, speculation can also contribute to price volatility and market manipulation. Excessive speculation can lead to inflated prices, followed by sharp price declines when speculation subsides. Therefore, the impact of speculation on market demand should be carefully monitored.

3. Market Adoption

The level of market adoption for Blur Token also affects market demand. As more individuals and businesses start using Blur Token for various purposes, such as online transactions or accessing certain services, the demand for the token increases. This increased demand can drive up the price of Blur Token.

Furthermore, partnerships, collaborations, and integrations with other blockchain projects or platforms can also contribute to market adoption and subsequently increase market demand for Blur Token.

4. Regulatory Environment

The regulatory environment surrounding cryptocurrencies and blockchain technology can significantly impact market demand for Blur Token. Favorable regulations, such as clear guidelines and supportive policies, can encourage more individuals and institutional investors to participate, leading to increased demand and higher prices.

On the other hand, unfavorable or uncertain regulatory conditions can create a sense of distrust and hesitation among investors, resulting in reduced market demand and lower prices for Blur Token.

In summary, market demand for Blur Token is influenced by factors such as investor sentiment, speculation, market adoption, and the regulatory environment. Monitoring and understanding these influences can provide valuable insight into the potential future direction of Blur Token’s price.

What are the external factors that influence the Blur Token price?

The external factors that influence the Blur Token price can include market demand, overall cryptocurrency market trends, government regulations, economic news, and investor sentiment.

How does market demand affect the Blur Token price?

Market demand can significantly impact the Blur Token price. If there is high demand for the token, the price is likely to increase. On the other hand, if there is low demand or selling pressure, the price may decline.

What role do government regulations play in the price of Blur Token?

Government regulations can have a significant impact on the price of Blur Token. If regulations are favorable or supportive of cryptocurrencies, the price may increase. Conversely, if there are strict regulations or bans on cryptocurrencies, the price can suffer.

How does economic news influence the Blur Token price?

Economic news, such as inflation rates, interest rates, or geopolitical events, can influence the Blur Token price. Positive economic news can drive up the price, while negative news can lead to a decline.

Is investor sentiment an important factor in determining the Blur Token price?

Yes, investor sentiment is crucial in determining the Blur Token price. If investors are optimistic and have a positive sentiment towards the token, it can lead to increased demand and a higher price. Conversely, if investors are pessimistic or have negative sentiment, the price may drop.

Leave a Reply